Intel Report #7: Blatant manipulation or insider information?

The next 4 years will be the craziest for the stock market

Table of contents:

Introduction.

The april 9 rally - What happened?

Trade wars and tariff policies and global geopolitical dynamics.

Scenario analysis.

Impact of tariffs on business and consumer spending.

Introduction

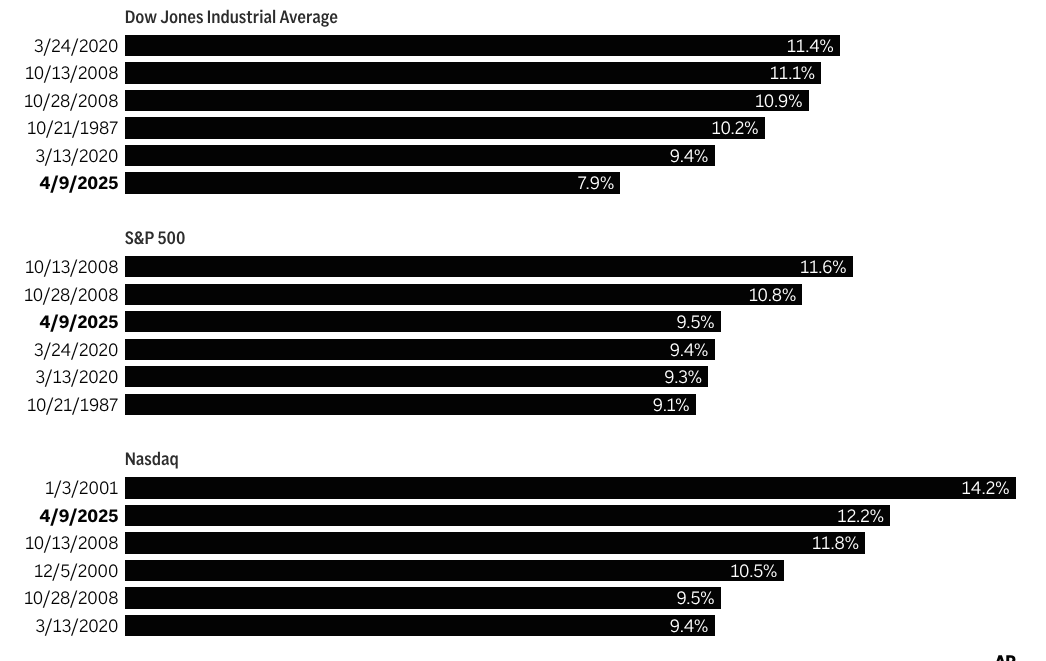

April 9, 2025, will go down in history as the day Wall Street staged a rebellion against despair. In a single, dizzying session, the S&P 500 surged 9.5%—a rally so fierce it erased weeks of losses and left analysts scrambling for comparisons. World War II, anyone?

The Nasdaq rocketed 12%, and the Dow catapulted nearly 3,000 points. But here’s the twist: This wasn’t a victory lap. It was a gasp for air in a world choking on trade wars, tariff tantrums, and geopolitical gambles.

The spark? A 90-day tariff ceasefire for 75 nations—but with a catch. China, the elephant in the room, saw its tariffs jacked to 125%, turning a momentary truce into a geopolitical grenade. Investors, desperate for respite after months of recession whispers and bond-market tremors, lunged at the lifeline. Yet beneath the euphoria lies a darker truth: This rally isn’t a reset. It’s a timeout.

Check it out:

The april 9 rally - What happened?

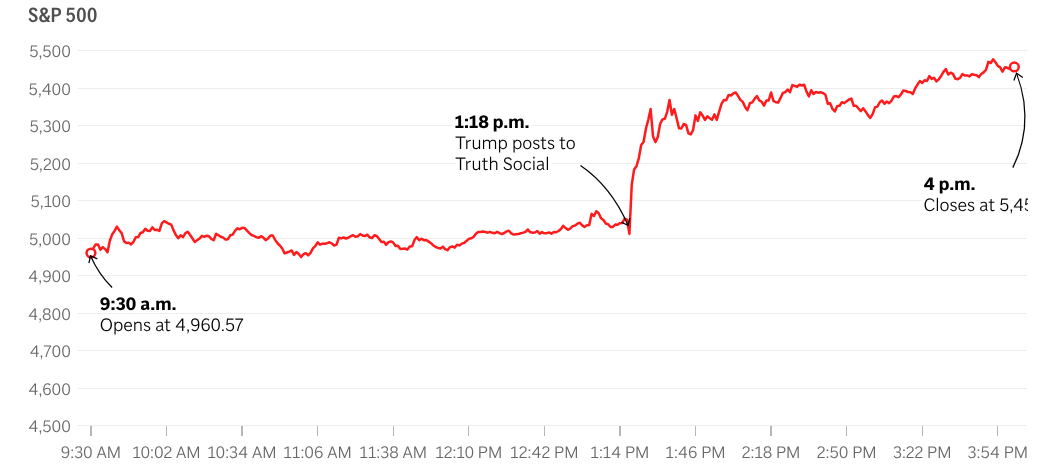

It began with a post—a single, incendiary tweet from President Donald Trump’s account:

Markets, already on edge from weeks of recession fears and bond-market tremors, exploded. Within minutes, the S&P 500 ripped upward like a coiled spring unleashed, soaring 9.5% by closing bell—a gain not seen since 1945. The Nasdaq, turbocharged by tech stocks desperate for relief from supply-chain chaos, rocketed 12%, while the Dow’s 2,962-point surge echoed like a financial earthquake.

Why the frenzy? Trump’s move was a geopolitical Rorschach test. For 75 nations, it was a carrot: a 90-day tariff ceasefire to renegotiate trade terms. For China, it was a sledgehammer—tariffs spiking to 125%, framed as punishment for “disrespect” in ongoing talks. Investors, battered by months of escalating tensions, interpreted the split decision as a rare signal of control amid chaos.

But context is key. In the weeks leading up to April 9, markets had been spiraling:

The S&P 500 had shed 14% since January, teetering on correction territory.

Treasury yields had swung wildly, with the 10-year note briefly topping 5.2%, stoking fears of a Fed policy misstep.

Consumer sentiment cratered as retailers like Walmart warned of “tariff-driven price hikes” by summer.

Trump’s tweet acted as a circuit breaker. By offering most allies a temporary off-ramp, he injected hope that a full-blown global trade war might be averted—even as China’s economy braced for a body blow. Algorithmic traders pounced first, triggering a cascade of buy orders. Human investors, initially skeptical, soon followed, desperate to front-run what they hoped was a policy pivot.

The irony? The rally wasn’t driven by optimism about resolution—it was a bet on delay. Markets priced in 90 days of reduced volatility, not a lasting fix. As one hedge fund manager quipped, “It’s like celebrating a stay of execution… while the executioner sharpens his axe.”

China’s silence in the hours after the announcement spoke volumes. By sunset in Beijing, state media had dubbed the move “economic terrorism,” and whispers of retaliatory measures began leaking. The rally’s afterglow faded fast. By midnight, futures dipped as reality set in: This wasn’t peace. It was a tactical retreat—and the real battle had just begun.

Drivers and interlocking factors:

Tariff reprieve: President Trump’s decision to pause the escalation on tariffs for 90 days provided a temporary relief for investors who were anxious about the fiscal and trade-related impacts on the economy.

Bond market signals: As Treasury yields stabilized after a period of sharply rising rates, the overall risk sentiment eased. Trump remarked that the bond market, which had been causing nerves, had “turned beautiful.”

Profit-taking expectations: With the market bouncing from a dramatic fall, many investors anticipated short-term profit opportunities, leading to rapid buying and a subsequent rally.

Sector-specific reactions: Companies in sectors highly affected by global trade—such as travel and technology—experienced pronounced volatility. For example, Delta Air Lines saw its shares surge by over 23% after releasing revised financial forecasts.

Geopolitical factors: The measured approach toward trade relations (pausing tariffs for allied nations while keeping a tougher stance on China) softened fears of an all-out trade war with other major economies.

Trade wars and tariff policies and global geopolitical dynamics

At the core of today’s market volatility lies a strategy as volatile as it is deliberate: tariffs as geopolitical chess moves. President Trump’s second-term trade doctrine has turned customs duties into a cudgel, wielded to fracture alliances, shield industries, and project dominance. The April 2025 pivot—a temporary tariff ceasefire for allies juxtaposed with a triple-digit assault on Chinese imports—epitomized this tactic. While most nations breathed a sigh of relief, China found itself staring down the barrel of what analysts dubbed “the mother of all tariffs,” a punitive escalation designed to force concessions.

The backlash was swift and scalding. Beijing retaliated with its own sweeping duties, pushing U.S. goods into a pricing stratosphere and igniting fears of a trade vacuum. The WTO now warns of a near-total disintegration of commerce between the two superpowers—a collapse likened to “unplugging the engine of globalization.” The ripple effects? Supply chains fraying at the seams, inflation metastasizing, and a projected $1.2 trillion hole in global GDP by 2026.

Critics argue this zero-sum game is backfiring. Tariffs, while politically potent, function like economic quicksand: The harder governments push, the deeper consumers sink. Case in point: U.S. retailers have already flagged price hikes on electronics, apparel, and auto parts, with middle-class households expected to shoulder an extra $200 monthly by year’s end. Businesses, meanwhile, face a grim calculus—slash jobs, delay expansions, or flee to tariff-safe havens.